Since Marx wrote his famous dictum that religion is the opiate of the masses, myriad alternative ideologies have flourished in the world. But with what do we drug ourselves today? Ultimately, money seems to be the most serious contender. Our lives are filled with dreams of acquiring it and spending it. The Church of Mammon has many holy rituals: using credit cards to buy more than we can afford; borrowing copiously for houses out of our reach; buying endless lottery tickets for the fantasy of a better life.

Behind all this lies the financial industry. Its sophistication repels the general public, who find its chicanery impenetrable. Though most people don’t know it, our monetary and banking system is essentially fuelled by debt. Without credit (loans) from private banks, there would be almost no more money in circulation. In other words, our modern economy stands firm only because the masses are captured by debt. This debt is driven by a consumer lifestyle which has become our second nature. Our lives are dominated by our need for one material item after the next, keeping us forever trapped in the consumer arena.

The Tyranny of Interest

At the heart of the practice of bank lending lies the idea of interest. Interest has become common in today’s world, but its history is mired in controversy. Interest is the amount due to the lender for the use of capital for a specified period. It is paid in the form of income. At very high rates it is called usury, but all interest becomes usurious through the compounding of money owed over time. Interest was for millennia prohibited, and its widespread acceptance today owes much to lobbying by profit-driven economic agents.

In Europe, the prohibition of interest was strictly adhered to in legislation, and Christian law, until at least the 13th century. However, it was not always stuck to in practice. The dichotomy between the legal prohibition and the actual practice of interest in Europe’s Middle Ages came from the inability of Christian theorists to propose a credible alternative financial system. Soon, with sophistical justifications of interest abounding, the law faltered. In England, the prohibition of interest was abolished in 1545 by Henry VIII and replaced by a set rate. The ban was then restored by Edward VI, before being finally abolished by Elizabeth I in 1571. The years that follow are not kind to interest’s reputation. It is perennially seen as an oppression, and Shylock’s character in Shakespeare’s play, The Merchant of Venice (1600), illustrates beautifully Elizabethans’ ambivalence over the taboo of this practice.

The reason for its past taboo is obvious – those with more money lend to those less well-off, but they gain a profit from the lending, without sharing any risk. The money is simply given, and usually secured with assets as collateral. Thus the debtor is left with the burden of paying off the full loan and interest, while the creditor is generally left with at least the principal repaid, if not much more. Purely by its ability to print money and loan it at interest, a modern bank can turn a guaranteed profit. But this profit is essentially unearned, for it did no work to contribute towards its acquisition. Meanwhile, the poor debtor must go out and earn the extra money owed as interest to the bank through sheer hard graft.

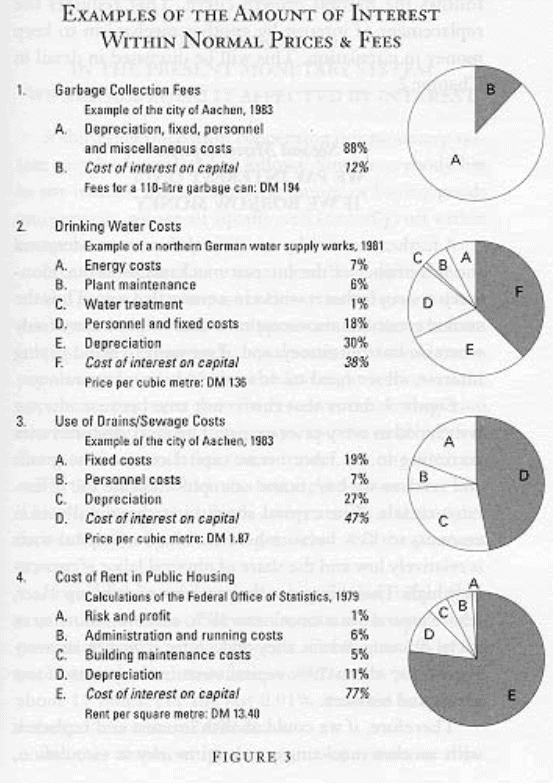

But this is not all. Apart from the situation of loaning, interest is applied to savings too. Naturally, those with the most savings earn the most money in interest. Thus, the wealth generated by an equal rate of interest on savings benefits the wealthy disproportionately. And so, through the twin mechanisms of interest-based lending and interest-accumulating capital, the rich get richer while the poor get relatively poorer. With their newfound money, the rich are then able to pay more than everyone else for capital assets such as houses, causing prices to rise. This again hurts the ordinary citizen, struggling now to repay the interest on their loan while trying to keep up with rising prices for capital goods. Not only this, but as Margrit Kennedy’s research showed in Germany, the cumulative effect of interest hugely inflates the prices of almost everything we spend money on.

At the macroeconomic level, the cost of debt becomes a brake on economic growth at the national and international levels. It hinders normal business life and creates risks of insolvency. On an international level, countries with excessive indebtedness can find relief by declaring bankruptcy or waiting for debt relief from creditor countries. This inevitably comes with strings attached, and sovereignty is lost. Once laid, the debt trap is nearly always inescapable.

Literature denouncing the harmful effects of the tyranny of usurious practice is legion. However, economists almost never bring themselves to propose its abolition. Why is this? One simple reason seems to be that interest, whether we like it or not, is a central feature of the capitalist system. Capitalism must be maintained, so interest is here to stay. Meanwhile its presence in the popular imagination is marginalized by a mainstream economic paradigm which progressively frees the economic debate of any moral arguments.

However, this approach is unsustainable and inexcusable. The practice of interest ensures that a significant part of the wealth produced by a nation falls into the hands of a few. It is therefore central to debates on distribution and equity. Such debates have an unavoidable moral dimension.

Even aside from the ethical dimensions, the obvious inequity interest creates threatens the stability of the entire economic system. At the psychological level, it imposes a business climate characterized by stress, the presumption of mistrust and selfishness. An excessive accumulation of capital occurs, creating a capitalist rentier class. This phenomenon transforms our society into a plutocracy, prone to economic monopolization; so much so that the principles of free competition and free enterprise are in practice greatly reduced.

Interest is the real opiate of the masses because the working classes need a powerful narcotic (bank credit) to withstand the social sufferings inflicted on them by this deadly system. Like an abuser to whom one keeps returning for comfort, interest is wielded expertly as both poison and treatment. Access to credit gives the downtrodden the illusion that they can access the same goods as the rich, and ultimately get the same status as the rentier capitalist. But the capitalist, through the rate of interest, forever reinforces his position, masking the reality of his brutal and iniquitous domination.

Although he scratched the surface of the topic with the concept of fictitious capital, Marx did not seek to remedy this part of the capitalist system. In fact, there is no prohibition of interest in Communist literature, which leads us to conclude that Communism is not fundamentally opposed to this institution. This means that Communism was a variant of the capitalist system, and not its real opponent. And perhaps in this lay its ultimate defeat.

Exploring Alternatives

Unfortunately, as long as the capitalist music lasts, we all dance on a volcano of debt. Yet, the storm clouds are gathering day by day. Alternatives must be considered, no matter how iconoclastic. Once entered for discussion and debate at the academic level, their merits can be seriously assessed. As we have seen, Communism was no real alternative. However, Islamic finance is a real alternative, being based on the explicit rejection of any form of interest. In addition to this, it promotes zakat (a marginal wealth tax), while prohibiting gharar (risky sale due to uncertainty) and maysir (gambling). Moreover, two further obligations of Islamic finance seem particularly interesting.

The first one is the obligation to share profits and/or losses. Stakeholders in the banking business are obliged to share risks in order to legitimize profit from money given. Money is therefore handed over as a ‘Dragons-Den’ style investment, rather than a simple loan with interest. If the business succeeds, the entrepreneur and the bank both receive a cut of the profits. If it fails, both share in the loss. This risk-sharing is cemented by partnership arrangements for the conclusion of commercial or financial transactions.

The second obligation of Islamic finance is that any financial transaction must be backed by real and tangible assets. The existence of an underlying asset makes it possible to establish the link between the real economy and the financial economy. Attached to the real economy, an Islamic financial system would inevitably lead to a more stable economy.

How would straight-forward loans work in this context? Islam teaches that interest-free loans can be given, and places an extremely high moral burden on repaying loans. However, if a debtor truly finds themselves in dire straits, Islam recommends that the creditor write off debt as an act of charity. Indeed, neither business realism nor magnanimity seems to have escaped the Islamic economic system:

“And if the debtor be in straitened circumstances, then grant him respite till a time of ease. And that you remit it as charity shall be better for you, if only you knew.”

The Holy Qur’an, 2:281

A complementary model of interest-free loaning worth exploring is found in the cooperative JAK Bank. Based in Sweden, it has been operating since 1970 and has been called the safest bank in the country. JAK’s primary objective is to provide its members with interest-free loans. In order to accomplish this, it must attract interest-free savings. JAK uses a system of “Savings Points” in order to balance saving and borrowing.

Imagine someone is looking for a loan of £10K. The JAK model would first take into account how much the individual already had deposited in the JAK bank. Let us say he has deposited £1K. The loan of £10K will be granted but instead of requiring him to pay interest, the JAK Bank model requires him to make savings. In other words, within his monthly repayment, the portion that was previously an interest repayment would now be personal savings, deposited into an allocated savings account for him to access after full repayment of the loan. The amount required to be saved is offset against the existing deposit made in the JAK bank — in this case, £1K. Thus, this individual would be required to save £9K with the JAK bank in addition to repaying £10K over the course of the same repayment period. The JAK bank then uses this extra £9K during the course of the repayment as liquidity for other loans.

Islamic finance, possibly incorporating elements of the JAK model, constitutes a viable and more just alternative to the interest-based system we currently have. Not only is it an opportunity for a better world, but it may be the only antidote to the fever-dream consumerism that centuries of interest-addiction have induced.

Special thanks goes to Dr. Julien Étienne Pélissier whose writings inspired this piece. Thanks also to Umar Nasser for helping shape it.

By the same author: Meccan Capitalism & the Economic Revolution of Islam

Very interesting and well written!

4.5

1