Introduction

Whenever we think of great Kings of the world, one name often comes to mind — Alexander the Great. For obvious reasons he deserves this reputation, but many are unaware that there was another important figure in history who was greater than many influential kings in every respect. This man has been written about, analysed, reviled, praised, overlooked, and misunderstood even by his own people. The personality in question is none other than ‘Umar al-Faruq ibn al-Khattabra, the second Caliph of Islam. Holding this position between 634 and 644 C.E., ‘Umar ibn al-Khattab’sra contributions to Islam are distinguished by his wisdom, practical intelligence, and outstanding leadership.

Indeed, with the same pioneering spirit as the Prophet Muhammadsa, his thought and policies concerning various economic issues are so impressive that one is left dumbfounded. In order to acknowledge his large achievements in the field of economic development or wealth redistribution, one must understand the context of his time. During this period of history, titanic changes were taking place, with the rapid and geographic spread of Islam, and old empires collapsing.

However, it would be unjust if we solely spotlight his achievements as an individual. Before recounting his successes, we must not forget that it was not his personality which helped him to establish such great economic reforms. Had Islam not existed, ‘Umar would not have become Faruq the Great. It was Islam that moulded his personality and understanding, and it was Islam that put forth a magnificent ideal (the Prophet Muhammadsa) for him to emulate, ultimately enabling him to trigger the second economic revolution of Islam.

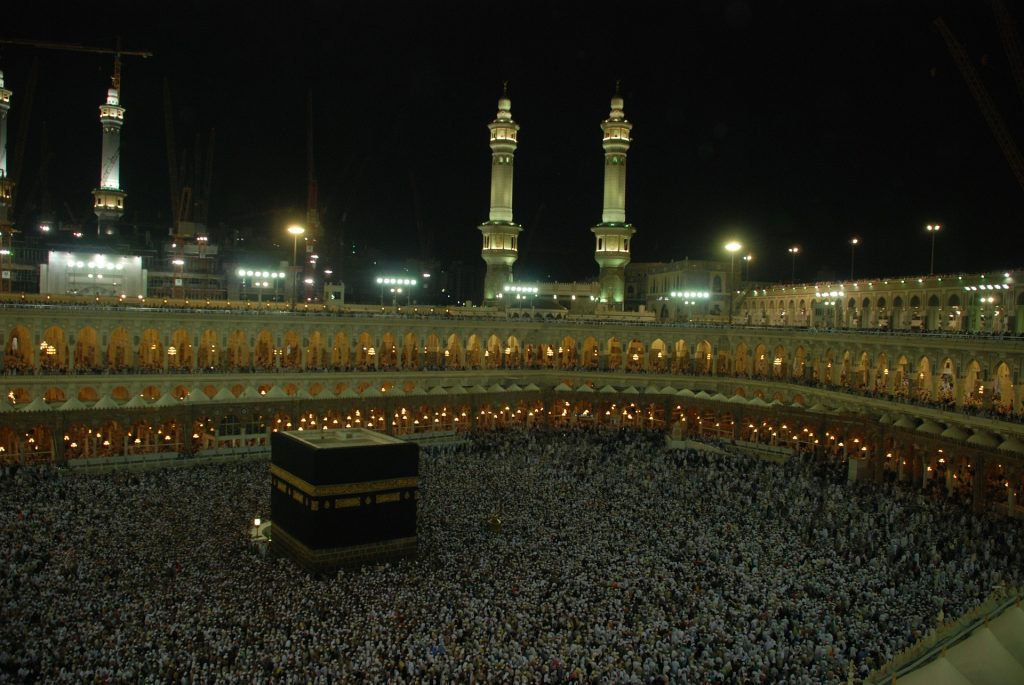

The Caliphate’s Rapid Geographical Expansion

The year 632 C.E. witnessed the most dramatic change in the lives of early Muslims: the death of the Prophet Muhammadsa. His death was inevitable and expected, with the Quran reminding Muslims that he is but a mortal messenger like those before him, warning them against any setback that might erupt after his demise (Holy Quran, 3: 145). The shock was severe but there was an eternal hope. Before the Prophet’ssa burial, two groups of Muslims debated the right to the caliphate (succession): the Medinite supporters (the Ansar) and the Meccan Emigrants. The dispute was resolved by swearing the oath of allegiance to Abu Bakr al-Siddiqra, the Prophet’s close companion, as the first Caliph of Islam.

Of the many ‘Caliphates’ that have come after the death of the Holy Prophetsa, the “Rightly-Guided Caliphate” (al-Khilafa al-Rashida) is the most highly esteemed in Muslim minds, and the most associated with righteousness and high spiritual values. From a religious perspective, the many political ‘Caliphates’ which came after the Rightly-Guided Caliphs were Caliphates in name only, not sanctioned by Islam as legitimate spiritual authorities. The Rightly-Guided Caliphate covered the years 632 to 661 C.E. and comprised four Caliphs: Abu Bakr al-Siddiqra (632-634), ‘Umar ibn al-Khattabra (634-644), ‘Uthman ibn Affanra (644-656) and ‘Ali ibn Abi Talibra (656-661).

Before his death in 634, Caliph Abu Bakrra designated ‘Umar ibn al-Khattabra as his successor. It must be noted that the designation of ‘Umar was made in the form of a recommendation, subject to the approval of the community. Indeed, there was nothing at all binding about it and the community could have rejected it had they wanted to (Shaban, 1971). The Quran emphasized the importance of mutual consultation (Shura) as the basic principle which should guide Muslims in the transactions of their national affairs (Holy Quran, 42:39). Muslims, however, approved his choice and ‘Umarra became the second Caliph.

Having begun under Abu Bakrra, Islamic external conquests reached a high peak at the time of ‘Umarra. Indeed, the second Caliphra started his Caliphate by completing the task which his predecessor had started: winning the war for Syria and Iraq. During the 7th century, two powerful Empires were surrounding Arabia: the Byzantine in the west, and the Sassanid in the east. Having seen the rapid rise of the Muslims in Arabia, they quickly mobilised to destroy the nascent empire. Thus the early Islamic empire was brought into direct conflict with the two superpowers of its day. These Empires had no tinge of justice in their governance. Power was in the hands of the kings and lords, and the general public was the victim of all kinds of atrocities.

On the Byzantine front, Damascus fell in 636 after a series of battles. When Khalid ibn al-Walidra, the general in charge, reached the Euphrates, he was welcomed by the Christian Arabs who lived in Syria. He made a treaty with the people whereby no Jews or Christians would be persecuted, freedom of religion would be ensured, and protection of people guaranteed. The Syrians also gladly accepted Muslims because they had ethnic and lingual ties — both were Arab and spoke Semitic languages. Also, the Syrians were fed up with Byzantine oppression and outrageous taxes.

Later in 638, ‘Umar’sra forces conquered Jerusalem; Caesarea fell in 641, and Ascalon too in 644. Meanwhile, led by ‘Amr ibn al-‘As, Muslim troops also marched into Egypt and the same pattern was repeated. The Monophysitic Egyptians felt alienated from the Byzantines, who spoke a different language, believed in a different form of Christianity and thought they were superior. The Byzantine governor, Cyrus, made every attempt to convert the ‘Copts’, and applied the usual exorbitant taxes. Muslims thus entered the country to the relief of the Egyptians, and defeated the Byzantines near Heliopolis in 640, resulting in the fall of Babylon. This victory allowed them entrance into Alexandria in 642. Cyrus was actually in favour of surrendering; however, the emperor of Byzantines, Heraclius, refused to allow him to sign a peace treaty with ‘Amr ibn al-‘As. Only after the emperor’s death in 641 was peace finally established in Egypt. The new Muslim inhabitants kept the same Byzantine administration, and did not oust the Coptic officials from their posts. A lighter tax on Christians and Jews was imposed, and no forcible conversion took place (Al-Baladhuri; Hitti, 1936; Holt, 1970; Hart, 1978).

On the Persian front, Muslims had similar successes. ‘Umar’sra forces met those of Emperor Yazdagird in Qadisiyya, known as the “gateway of Persia”. Rustam, the Sassanid commanding general, led an army six times that of the Muslims. Despite this enormous disadvantage and an early defeat in 634, Muslims achieved a decisive victory in 636 and all of Iraq west of the Tigris river was claimed by them. Ctesiphon, the capital of the Sassanid Empire, fell in 637. A final victory in Nahavand in 642 sealed the fate of the Sassanid Empire. That put an end to the Persian resistance in Iraq and forced Yazdagird to retreat to Istakhar, the old Persepolis and, oddly enough, he was killed by a local Persian in 651. After that, ‘Umarra did not want to pursue the Persians any further, and Muslims concluded fairly similar treaties with Persian cities as was previously done in the Byzantine territories (Al-Baladhuri; Al-Tabari; Hitti, 1936; Holt, 1976).

Keeping the Muslim community united, ‘Umarra kept the native administrations of the countries that the Muslims entered and just appointed governors; this limited tension and discord. In general, there was overwhelming support of his leadership, and this kept the community unified (Hold, 1970). This unity strengthened his administration and avoided internal bickering.

Ownership of Land

The expansion of the Islamic Empire brought with it changes in Islamic society that necessitated a fresh outlook in dealing with economic issues. The most notable example of the novelty in ‘Umar’sra economic thinking was demonstrated in his attitude towards the ownership of land as a factor of production. Indeed the Caliph was of the view that if land, as a building block of economic activity, was properly utilised, it would generate wealth and commerce (El-Ashker & Wilson, 2006).

After the conquests, Muslims warriors advocated that, in accordance with the rules of the Quran, the conquered land of Iraq and Syria should be distributed among them. Caliph ‘Umarra disagreed. He was of the opinion that the land should be kept in the hands of the State, i.e. that it should be nationalised. He advised that a tax be imposed on the original owners, from which Muslims would be paid stipends. To understand the character of this problem, and Caliph ‘Umar’sra approach to solving it, it is worth looking into the system of dividing the spoils of war among the warriors as stated in the Quran.

The allocation of spoils (Ghanima) was ordained in the Quran as follows:

“And know that whatever you take as spoils in war, a fifth thereof is for Allah and for the Messenger and the kindred and the orphans and the needy and the wayfarer”

The Holy Quran, 8: 42

In this distribution, the warrior would keep four-fifths of what he gained in the battle, and pay the Prophet, or the head of the State, one fifth (Khums) which would be distributed among the Muslims. During the time of the Holy Prophetsa, the remaining four-fifths were divided among the soldiers because they were paid no salaries and in general had even to incur the expenses of wars themselves. This was an exigency measure adopted to meet the conditions then found, as there was then no regular army and no State treasury.

Thus, Muslim warriors claimed the right to four-fifths of the spoils, including land, with one-fifth to be paid to the State — the Ghanima distribution. Caliph ‘Umarra disagreed by making a difference between mobile and immobile assets (El-Ashker & Wilson, 2006). For mobile assets, the Quranic rules were to be applied (one-fifth to the State and the rest to the soldiers). But for immobile assets, particularly those of land, they were to become the property of all citizens through the State. With the right of ownership resting with the State, the land would remain in the hands of the original owners who would utilise them and be liable for the payment of a land tax (Kharaj).

The reasons that led ‘Umarra to make such a decision were both religious and economic (Abu Yusuf). According to him, the land that Muslim soldiers conquered had the potential to turn Islamic society into a feudalistic society, where the warriors became the aristocracy who held all the new land and thus all the new wealth. He knew that the distribution of land to Muslim soldiers was bound to create a powerful class of landlords who could become a parasite for the flourishing economy. Indeed, at a time when a feudal system was in vogue around Arabia, people were accustomed to permanent proprietary rights over land.

But Caliph Umarra opposed this strongly and took a revolutionary step: he abolished absentee-landlordism, and through nationalisation, changed the entire system of land ownership in the Islamic Empire. To justify this, he referred to the Quranic verses on the distribution of new wealth and concluded that whatever method of distribution was adopted must prevent the circulation of wealth only amongst the rich:

Whatever Allah has given to His Messenger as spoils from the people of the towns is for Allah and for the Messenger and for the near of kin and the orphans and the needy and the wayfarer, that it may not circulate only among those of you who are rich.

The Holy Quran, 59: 8.

Lastly, the welfare of future generations, according to Caliph ‘Umarra, should not be sacrificed for the well-being of the present one. He is reported to have said, “If I distributed land, nothing would be left for those who will come after you and who will find that the land had already been distributed and inherited” (Abu Yusuf). In other words, the distribution of the new land among soldiers would have limited tax revenues and thus the ability of the State to establish the system of social security ‘Umarra envisaged. Although his council was divided, the debate ended with the approval of the proposal of the Caliph.

National Development

If the policies of the second Caliphra regarding the conquered land are analysed in a broad economic context, they depict his awareness of two main economic issues in the early Islamic state: national economic development and wealth distribution. The efficiency of using natural resources in general, and the productivity of land in particular, seemed to have been a primary target in ‘Umar’sra economic development. His attitude regarding the conquered lands was akin to an economist’s attitude towards land as a means of production (El-Ashker & Wilson, 2006). He left the land in the hands of the original owners who were more capable than the Arabs of cultivating it. Furthermore, in imposing land tax (Kharaj), the base was the cultivable land regardless of whether the land was actually being cultivated or not. That was deemed to increase the utility of the land as a means of production.

A closer look reveals similarities between Kharaj and the modern economic idea of a Land Value Tax (LVT). The latter seeks to raise public revenue by means of an annual charge on the value of land. Indeed, taxing land is seen as practical and non-distortionary because land is an immobile asset. It is also seen as efficient because it encourages landowners to use the land as productively as possible. In economic theory, an LVT is a straightforward attempt to collect tax on what economists traditionally called the ‘unearned betterment’ part of the value of a property — the rise in value that has nothing to do with the owner’s efforts and everything to do with the community’s.

The emphasis of the second Caliphra on the efficiency of using land as a means of production was demonstrated further on the cases of reclaiming barren land, and of owning more land than what one could afford to look after. In the case of reclaiming barren land, Caliph ‘Umarra, in line with the Islamic teachings, instructed, “Whoever revives dead land becomes its owner” (Abu Yusuf). When no one had ownership over barren land, no argument was likely to arise, but a dispute might erupt if the land had an original owner. For the second case, the Caliph emphasised, “there is no right to the holder after three years of no utilisation” and “if someone else, or a group of people, came along and utilised the abandoned part he, or they, may claim the ownership of that part” (Abu Ubaid; Al-Mawardi).

The second Caliph’sra awareness of the need for the full use of economic resources did not stop at the level of land as means of production; it went further to reach human resources and capital. His policies on labour were characterized by encouraging people to have an occupation, to learn and train, to give up laziness under the pretence of religious devotion, and to strive through work for the sake of God. Furthermore, the second Caliphra seemed to have realised the relationship between unemployment and civil unrest as early as the mid-seventh century. In his directions, he is reported to have stressed, “God has created hands to work, if they cannot find work in obedience they will find plenty in disobedience, so keep them busy in compliance before they get you busy with defiance” (Al-Ghazali).

Beside land and labour, capital as a means of production also occupied the attention of the second Caliphra. He stressed the importance of spending on only what is needed for the sake of increasing savings, and maximising the ability to invest. In his stand on the rationalisation of consumption for the sake of saving, ‘Umarra advised that people should limit their consumption and not be excessive in the purchases, as is taught in the Holy Quran (25: 68). Furthermore, to help people with starting capital, the Caliphra took the initiative of distributing barren land to those who were capable of utilising it, granted them its ownership, and offered financial help to those who were in need for help in cultivating it (Abu Yusuf).

If, during the Caliphate of Abu Bakrra the State could be considered as economically weak, then during the Caliphate of ‘Umarra, with the first wave of victories, wealth began pouring in. As a result, ‘Umarra considered it necessary to thoroughly reform this vast territory, whose area was enlarged after the conquests of Syria, Iraq and Egypt. Having reorganised the territorial organization of the Muslim provinces, Caliph ‘Umarra gave the Public Treasury (the Baitul Mal) the shape of an economic institution. Indeed after the conquests, the income which reached the centre (Medina) was so huge that he had to think about how to utilise it wisely for long-term prosperity. At the same time, the burden of the organisation of armies and the administration of conquered lands also increased. Money was also needed for public welfare plans. Hence, it was necessary that this wealth should not be spent haphazardly but be kept safe at some place. This led to the creation of the institution of the Baitul Mal.

Caliph ‘Umarra was very careful about the management and safety of the treasury. He was aware of the fact that mismanagement, if once allowed, would one day go beyond control. With this view in mind, he took every possible care in the selection of treasurers, for which he selected only those whose ability and honesty were beyond doubts. Another important step which he took for the proper management of the treasury was that it was not mixed with the executive. In provinces, officers in charge of the treasuries were independent of the governors and they had full authority to use their powers. Each province had a collector of taxes (Sahib al-Kharaj) and a Treasury Officer (Sahib Bait al-Mal).

Wealth Distribution

Regarding wealth distribution, the other factor in economic welfare, we find that this was taken care of in two principal ways. The first was the institution of Zakat, which was already established in the Quran, while the second was a system of stipends that was introduced by Caliph ‘Umarra. Revenues of Zakat were to be spent in a particular manner specified in the Quran in which the beneficiaries are “the poor and the needy, those employed in connection therewith, those whose hearts are to be reconciled, and for the freeing of slaves, those in debt, for the cause of Allah, and for the wayfarer.” (The Holy Quran, 9: 60). A further reinforcement to Zakat revenues came, as mentioned earlier, from that of Khums, which is one-fifth of the spoils of war.

The second tool of wealth distribution in the community was a stipend system which was introduced by Caliph ‘Umarra. The allowances were of two types: monetary allowances and allowances in kind. He institutionalized the new social structure based on an Islamic hierarchy by creating what came to be known as Diwan ‘Umar – loosely meaning the Ministry of Umar, or the Umar Plan. This hierarchy, with its material underpinnings in the form of stipends, had its foundation in Islam (al-sabiqa fi al-Islam). The earlier one accepted Islam, the higher one’s position and stipend was; those who joined Islam before the Battle of Badr received higher stipends (5,000 dirhams each annually) than those who joined after the conquest of Mecca (3,000 dirhams each annually). The Prophet Muhammad’ssa family members received special honour and were placed in a higher category than the rest. The Prophet Muhammad’ssa wives and uncles, for example, received an annual stipend of 12,000 dirhams; Hasanra and Husainra, the Prophet’ssa grandsons, each received 5,000 dirhams (Al-Tabari; Al-Baladhuri). The reason for the disparity was obvious — those who joined earlier made much greater sacrifices, suffering for years under persecution.

A similar system for the distribution of stipends was established in the provinces. This system was also based on the date of first participation in the Islamic expansion; those who fought in the early battles received higher stipends than those who joined later, when most of the battles had been won. There were three categories: those who participated in the earliest battles of the expansion (ahl al-Ayyam); those who participated in the decisive Battle of Qadisiyya (ahl al-Qadisiyya); and the latecomers (rawadif). The first category received an annual stipend that ranged over time from 5,000 to 3,000 dirhams, with extra for additional valour; the second received between 3,000 and 2,000 dirhams. The third category received stipends ranging between 200 and 1,500 dirhams, based on the date they moved to the provincial capitals to be registered.

Women and infants from the day they were born also received a share, 200 and 100 dirhams respectively (Al-Baladhuri; Hinds, 1971). Every infant, in addition of their allowance, received a portion of corn monthly. On attaining the age of one year the allowance was doubled (i.e., 200 dirhams annually), and on attaining the age of maturity every child received 300 dirhams annually. Orphans were kept in line with other children. They received an allowance of 100 dirhams which increased as in ordinary cases. Guardians of such children were given separate pay and allowance. Clothing, shelter and education of such children was a State duty (Ra’ana, 1975). Thus we say that the Caliph Umarra pioneered a social walfare system that even today’s most progressive politicians could not match.

The Caliph’s Personal Empathy

Caliph ‘Umar’sra sense of justice (‘adl) does not seem to have been merely theoretical. Indeed, there are many accounts of his being a true man of the people, patrolling the streets in person to see the state of the population under his responsibility.

One account says that one day, Caliph ‘Umarra saw, in the presence of man named Aslam, a campfire outside the city of Medina. As they approached the fire, they saw a woman with some young children screaming. The Caliphra greeted the woman and asked if he was allowed to approach her. The woman returned the greeting and replied: “Bring us some good or leave us alone.” The Caliphra then asked her what had happened to the children. She told him that nightfall and cold had overtaken them, and that hunger was making her children cry. She had a pot set up over the fire to which the Caliphra asked what was in it. She told him there was water for her children. Not recognizing the Caliph, she added: “I ask God to judge between us and ‘Umar!” The Caliphra replied: “God have mercy upon you, how can ‘Umar know anything about you?” To this she replied: “He is in authority over us, and yet he neglects us.”

Visibly shaken, the Caliphra left with Aslam, and went to the flour store from where he took out a measure and put a ball of fat into it. When the Caliphra started carrying all this, Aslam proposed to carry it on his behalf. But ‘Umarra insisted and said: “Will you carry my burden for me on the Day of Resurrection, you wretch?!” He thus took all the food and they rushed to get back to the woman. The Caliphra gave her the food and began to cook the bread with her. Once it was made, he told her to feed her children until they were satisfied. Gratefully she said: “God give you a good reward. You have done better in this matter than the Commander of the Faithful!”. Keeping his identity hidden, ‘Umarra replied: “Speak well of him, for when you come to the Commander of the Faithful, you will find me there, God willing”. After slightly stepping away from her, Aslam said to him that they should leave now as he has other things to do. But the Caliphra remained silent until he saw that the children had fallen asleep. After praising God, he turned to Aslam and said: “Hunger kept them awake and made them cry. I did not want to leave until I could see them doing what I see now!” (Al-Tabari).

Other measures

Custom duties (‘Ushur)

Besides Kharaj, another tax introduced by Caliph ‘Umarra was the ‘Ushr or custom duties. At the recommendation of one of the Caliph’s governors, Abu Musa al-Ash‘ari, the tax was initiated as a reciprocal tax to that which Muslim merchants paid to foreign states on crossing their borders. The rate of the tax was one tenth, or ‘Ushr (the plural of which is ‘Ushur), which was determined at the same rate that was imposed by foreign countries on Muslim merchants. In the words of Abu Musa in his letter to ‘Umar, “Muslim traders from our dominion go to the country of the enemies and they levy ‘Ushr (one tenth) on them”, to which ‘Umar replied, “Take ‘Ushr from them just as they charge from the Muslim traders”. Other characteristics of the ‘Ushur tax were that the tax had a threshold of 200 dirhams below which it would not be taxed, it was levied once a year on the same goods transferred regardless of the number of times they crossed the borders, and it was imposed on external trade with no levy on the transfer of goods among the state provinces (Abu Yusuf).

Public works and infrastructure investment

Caliph ‘Umarra took keen interest in public works and built many canals, buildings and cities. The canals which were needed for the promotion of agriculture. Among them, there was the “Abi Musa Canal”. It was 9 miles long and was brought from the river Tigris to supply water to the people of Basra, who had complained to Caliph ‘Umarra about the scarcity of water in their city. Another worth mentioning is the “Amir al-Mu’minin Canal”. This canal joined the Nile and the Red Sea, and was the most useful canal at that time. Around 640-641, when Arabia was affected by a severe drought and famine, the Caliph ordered the provincial governors to send food grains to the capital. This order was complied with, but the land-route from Egypt and Syria being very long, it took a long time for the food grains to reach Medina. Caliph ‘Umarra thought of connecting the Nile and the Red Sea by a canal to reduce the distance and thus to enable the provisions to reach Medina more quickly. He sounded the governor of Egypt on the matter, who completed a 69-mile-long canal in six months. It also helped increase the sea traffic to a great extent; in the first year twenty ships carrying a large amount of food grains reached Jar, the port of Medina (Ra’ana, 1975).

Urbanization

One of the practices which took root in the Islamic world through Caliph ‘Umarra was the art of managing the fiscal and accounting affairs of the public treasury. Other practices included urban planning and deliberate architecture, with the result that, upon the order of the Caliph, two cities (Kufa and Basra)were built in Iraq, and one in Egypt (Fustat). When Kufa and Basra were being constructed, he paid much attention to the layout of the avenues, the width of the streets, and the centrality of the mosque in both cities. These cities and the investments made in them also facilitated the process of development. All these measures allowed the accumulation of wealth and capital in the economy of the early Islamic period. For this reason, aggregate supply increased in tandem with aggregate demand; consequently, the value of money and price levels remained stable, except during the few years of drought (Sadr, 2016).

Conclusion

It is clear from the above that the second Caliphra attached a great importance to natural resources as a means of production and endeavoured to maximise the benefits generated from these resources. ‘Umar’sra policies, with regard to ownership of means of production, were neither capitalistic nor communistic, to use modern economic terms, but a reflection of Islamic economic teachings. Private ownership is highly regarded in Islam provided it is not abused. If it is abused, the State has the right to step in and rectify the situation. After all, the ownership is ownership by trusteeship between a man who is delegated to own and God who owns everything. Nationalisation was not therefore one of the State’s general policies, it was only a necessary step taken to rectify a situation and prevent the misuse of economic resources.

In addition, Caliph ‘Umar’sra policy on wealth distribution was based on a compromise that benefited the many. This was demonstrated by the fact that everyone, including infants, received a share of the wealth following the conquests. It is for this reason that his Caliphate is considered the first major Welfare State in the world, and served as a model for subsequent nations.

One thing is for certain: his shadow and his example will continue to prevail and dominate us for a long time yet. ‘Umarra was a great ruler and he had a lasting impact on not only his reigning region but the entire world. It is high time that we grant him back, according to the expression of historian Lucien Febvre, his “right to history”.

5

Great story of Umar bin Ibn al-Khattab. May allah give you more knowledge.

4.5

It is really impressive!